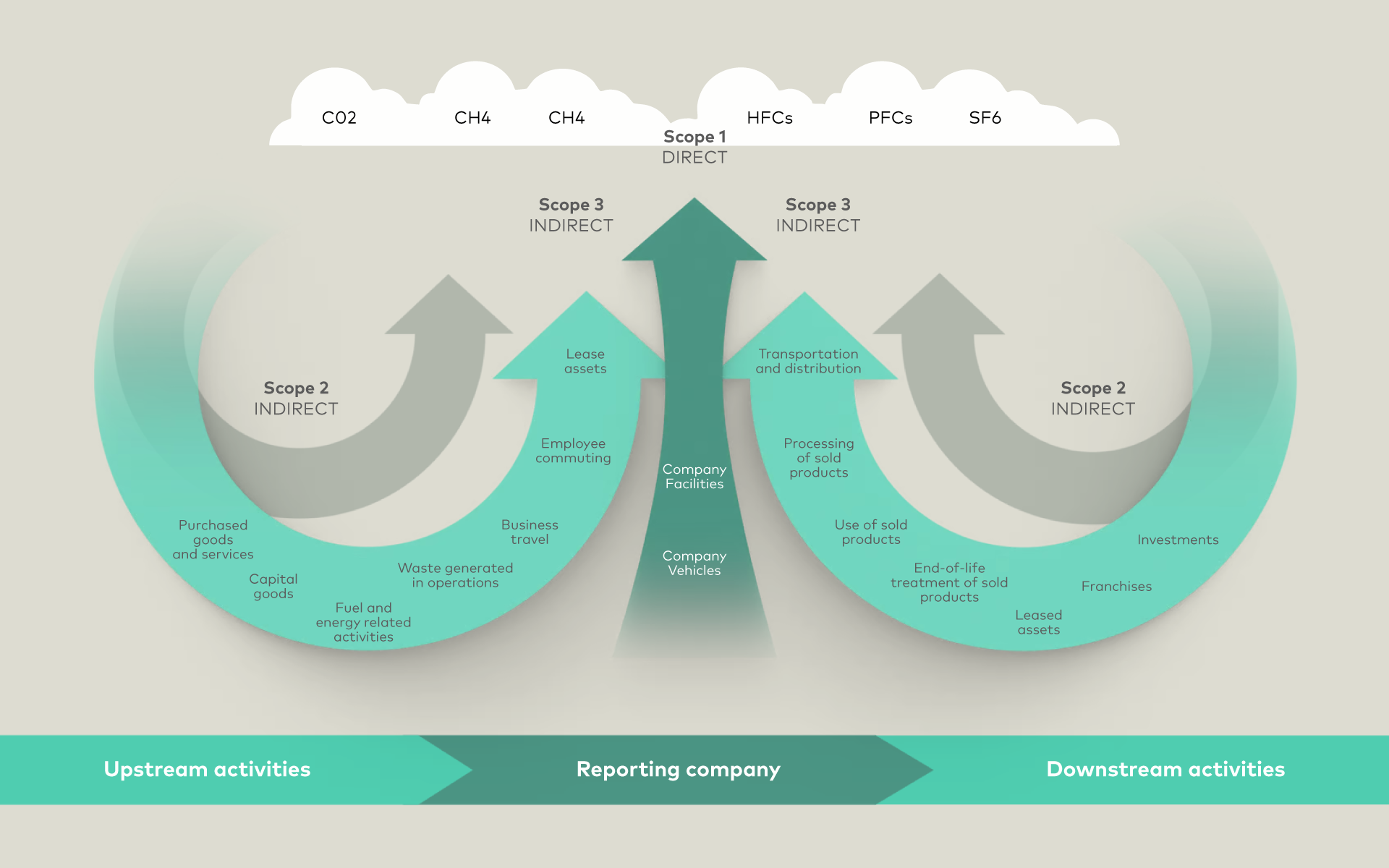

Even as governments and companies embrace sustainability, Scope 3 reporting has remained a blind spot, for a variety of reasons. But it may not be for much longer as the regulatory environment changes and as consciousness of how Scope 3 reporting can help in reaching net-zero goals spreads. Happily, there are a number of steps that companies can take to put themselves in a better position to handle Scope 3 reporting challenges and prepare for a greener, more sustainable future.

Mastercard has a broad ESG portfolio, including its Consumer Carbon Calculator powered by fintech Doconomy, the Priceless Planet Coalition, the Data and Services ESG offering and its Sustainability Lab. Mastercard's Start Path program also invests in ESG startups such as Carbon Neutral Club. It enables employees to calculate, offset and reduce their personal carbon footprints through employer-driven engagements. Leveraging the reach of a large network and broad merchant base, Mastercard could play a role in Scope 3 reporting by providing centralized and secure data and deploying a network that enables its easy distribution.