What’s in the cards?

April 5, 2023 | By Vicki Hyman

Billions and billions of cards have been produced over the decades, and while the dimensions have largely remained the same, new technology, design trends and concerns about accessibility and sustainability have evolved how they look, feel and work.

The latest transformation coming to your wallet? Building on its work to encourage the use of more sustainable materials in payment cards, Mastercard announced today that starting in 2028, all newly produced cards issued on the company network must contain sustainable materials, such as recycled or bio-sourced plastics.

The pandemic-fueled acceleration of contactless payments has led to a huge uptick in mobile payments, and now people can even choose to forgo physical cards entirely. More than 250 banks and other customers are offering digital-first issuance through Mastercard, where virtual cards can be issued in real time and used immediately, with a physical card optional. But physical card issuance remains robust — a tangible token in an increasingly virtual world.

Here’s a brief look at the changing face of cards.

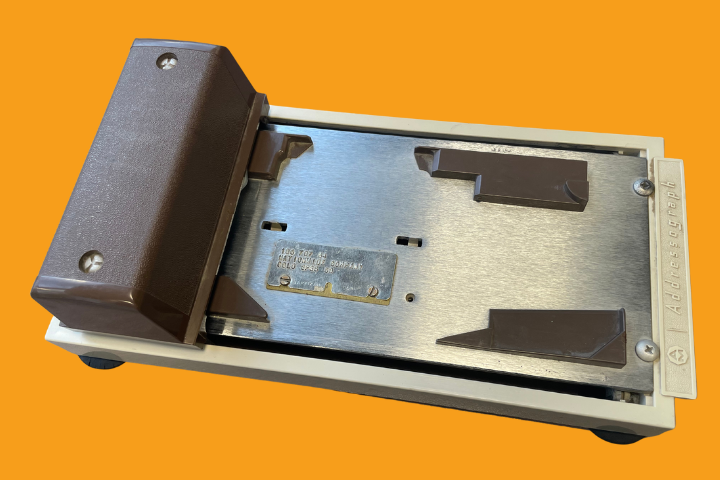

Making an impression: Embossing

The earliest modern credit cards were made of cardboard and printed with the cardholder’s name. As the concept of consumer credit expanded in the 1950s and 1960s, banks and merchants needed a more efficient way of processing transactions. Enter embossed plastic cards and the card imprinter, also called a zip-zap machine for the action of running the handle back and forth over the card to imprint the information onto carbon-paper packets. (It was also nicknamed the knuckle-buster by clumsy cashiers, for the layers of skin occasionally sacrificed to the gods of commerce.)

A swipe at security: The magnetic stripe

A 1960s invention largely credited to IBM, magnetic tape contained encoded card information that could be read and relayed by point-of-sale terminals with a simple swipe. Magnetic stripes remained in popular use for decades until the popularization of chip cards in the 1990s and 2000s. In fact, magnetic stripes now have an expiration date: In 2021, Mastercard became the first card network to announce it would no longer require newly issued credit and debit cards to have the stripe starting in 2024 in most markets. By 2033, no Mastercard cards will have magnetic stripes. (Mastercard also ditched the requirement for signature panels on the back of cards in 2019.)

Chipping away at fraud: Smart cards

These microprocessors turned thin plastic slabs into tiny computers, offering even more security in authenticating payments. First used in the 1970s, they took a while to catch on, because different chip cards didn’t work with every terminal, leading to the development of a global EMV chip technology standard in 1994. And this led to a host of other innovations, from contactless transactions, which are enabled by an antenna embedded around the perimeter of the card, to tokenization, which turns the card’s account number into a unique alternate number for increased security, to biometric cards, with a fingerprint sensor to verify identity.

These microprocessors turned thin plastic slabs into tiny computers, offering even more security in authenticating payments. They took a while to catch on, because different chip cards didn’t work with every terminal, leading to the development of a global EMV chip technology standard in 1994. And that led to a host of other innovations, from contactless transactions, which are enabled by an antenna embedded around the perimeter of the card, to tokenization, which turns the card’s account number into a unique alternate number for increased security, to biometric cards, with a fingerprint sensor to verify identity.

Getting a glow-up: Personalization

The late 1980s saw a spike in affinity cards, payment cards — tied to charity groups, universities and sports teams among others — heralding a new age of distinctive branded and, later, customized card design. The turn of the millennium saw the emergence of metal cards with their prestigious “plunk factor” — from stainless steel to titanium to even solid gold cards and ones embedded with precious gems. Some card issuers now let you customize your card, whether it’s choosing from a library of images or submitting your own. Last year, the crypto and fiat financial app hi launched a Mastercard debit card that eligible cardholders could personalize with an NFT avatar they verifiably own.

There are limits, however. Mastercard’s 191-page card design standards manual prohibits sexual and political subject matter, among other restrictions, and employs a team to review nearly 55,000 physical card design submissions and a growing number of virtual designs each year.

Trust at a touch: Accessible cards

The size and shape of a credit card — including its thickness and corner radius — has been standardized for decades, but there is some wiggle room, provided the shape doesn’t interfere with the mechanics of the transaction. Mastercard made use of that in 2021 when it created the Touch Card, with a system of notches on the side of the card so people who are blind or visually impaired (or even someone reaching for their card in a dark space) can feel whether they’re holding their debit (rounded notch), credit (squared) or prepaid (triangular) card. It’s now available through dozens of issuers on five continents.

A material difference: Sustainable cards

Billions of payment cards are produced each year, most made from PVC and other first-use plastics. It’s a relatively small contribution to the global plastic waste problem, but an unnecessary one, as there are dozens of alternatives, including high-density polyethylene, which can be made from recycled plastic bottles, and polylactic acid, a bio-sourced plastic made from corn or sugar starch. (No, it’s not edible, but when it’s incinerated at the end of its life cycle, it releases no carbon dioxide.) More than 168 million cards from over 300 issuers have already been certified by Mastercard as sustainable, and starting in 2028, all new payment cards issued on the Mastercard network must be made with sustainable materials, upping the ante for even more innovation.