Pandemic’s e-commerce surge proves less persistent, more varied

March 17, 2022 | By Joel Alcedo, Alberto Cavallo, Bricklin Dwyer, Prachi Mishra, and Antonio Spilimbergo

There’s no doubt that e-commerce helped us navigate the pandemic, from online shopping to curbside pickup to food delivery. But as we slowly emerge from lockdowns and other COVID-19 restrictions, it is less clear how this shift to digital commerce may evolve across economies and industries.

How much did digital consumption increase overall? Did the crisis widen the digital divide or spur economies with little e-commerce to catch up? How permanent is the shift to online sales and what factors explain deviations between economies and sectors?

We investigated these questions in new research that uses a unique database of aggregated and anonymized transactions through the Mastercard network from across 47 countries from January 2018 to September 2021. We found that the share of online spending rose more in economies where e-commerce already played a large role — and that the increase is reversing as the pandemic recedes.

This research, a new partnership between Mastercard, the International Monetary Fund and Harvard Business School, shows how private-sector data can help advance empirical economics and will be the first in a series of such studies.

Variation across economies

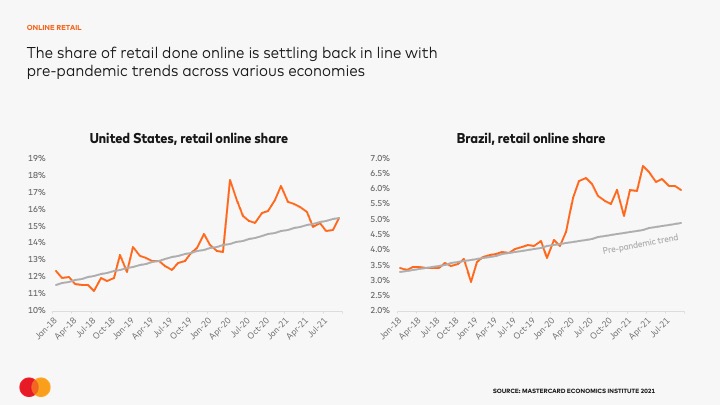

On average, the online share of total spending rose sharply from 10.3% in 2019 to 14.9% at the peak of the pandemic, but then fell to 12.2% in 2021.

Though the latest online share of spending is higher than before the pandemic started, it is only 0.6 percentage points above the growth trend for e-commerce had the pandemic not happened. While most economies are now below those peak levels, there are still significant differences among countries.

Online share of spending is still above pre-pandemic trends in about half of economies, from large emerging economies such as Brazil and India to other middle-income countries such as Bahrain and Jamaica. In all the others, including the U.S. and many advanced economies, the online shares are now either at or below the predicted pre-COVID trend levels. The pre-COVID trend is estimated in each economy using a simple extrapolation of time trend before the pandemic and reflects what would have been predicted in the absence of the crisis.

We find that e-commerce increased more in economies with a higher pre-COVID share of online transactions in total consumption, exacerbating the digital divide across economies. For example, Singapore, Canada and the U.K. had high shares to begin with, and their online penetration went up even more during the pandemic. On the other hand, countries including Brazil and Thailand had low online shares pre-COVID, and they experienced less of an acceleration.

How persistent was the effect on online sales? Strikingly, the latest data suggests that the spikes in online spending shares are gradually dissipating at the aggregate level.

The average online spending share at the peak of the crisis was 4.3 percentage points above the level that would have been predicted in the absence of the pandemic. This difference drops to only 0.3 percentage points by the end of our sample period.

Pandemic restrictions, fiscal support

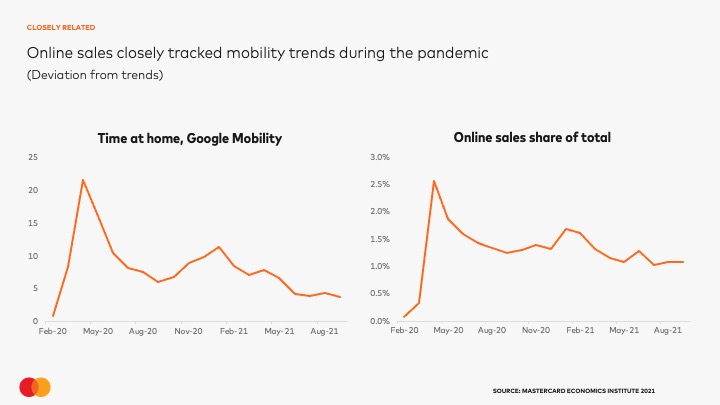

One possible explanation for the variation across economies, and in online share of spending, is the difference across pandemic-related restrictions on mobility. Not surprisingly, economies with stricter mobility restrictions saw strongly higher online spending.

This was particularly true at the beginning of the crisis in the second quarter of 2020, when lockdowns severely curbed movement in most economies. However, as the pandemic continued, that correlation between restrictions and online spending weakened — consistent with the declining impact of lockdowns and other restrictions on economic activity over time.

In addition, fiscal support during the pandemic helped boost e-commerce penetration, likely by increasing consumption, which, in the presence of pandemic restrictions, could mostly be done online. Wealthier, more digitally mature economies also returned faster to pre-pandemic pace of online spending once the COVID crisis receded.

Longer-lasting effects

One common narrative is that the pandemic accelerated digitalization, forcing consumers to learn how to shop online, and that this learning was here to stay. While our results support the quick uptake of e-commerce, the persistence of learning does not appear broad-based. That said, we find significant variation by industry. The embrace of e-commerce appears to be particularly longer lasting in restaurants (e.g., food delivery), health care (e.g., telemedicine) and some categories of retail, including department stores, electronics, and clothing.

During the initial surge of the pandemic, there was a big demand for e-commerce relative to in-person commerce. Economies and sectors already familiar with some of the technologies were able to go online to a larger degree. While the pandemic forced consumers to learn quickly, our results suggest that early adopters further extended the use of e-commerce within their economies.

Further, there are two possible explanations for the lack of consistency in the embrace of e-commerce across industries. First, this could reflect that mobility hasn’t fully recovered, along with the in-person nature of some sectors such as dining. Second, digitalization in these same sectors wasn’t particularly high before the pandemic, but those were the areas COVID-19 propelled the shift the most.

The share of online spending rose and fell most dramatically in those economies and sectors where e-commerce was already thriving before the pandemic. Industries with lower levels of digital maturity — including retail, restaurants, and health care — have a greater runway for e-commerce, particularly in less developed markets, making them potentially ripe for disruption.

The geographical research included in this story was gathered from the IMF working paper published on January 28, 2022.

Joel Alcedo, Vice President, Applied Economics, Mastercard

Alberto Cavallo, Edgerley Family Associate Professor, Harvard Business School

Bricklin Dwyer, Chief Economist and Head of the Mastercard Economics Institute

Antonio Spilimbergo, Deputy Director, Research Department, International Monetary Fund