Work / Life divide: Just a quarter of women believe they are financially supported in the workplace, Mastercard reveals

March 7, 2024 | Waterloo, BelgiumAhead of International Women’s Day, Mastercard examines what financial empowerment means for women across Europe.

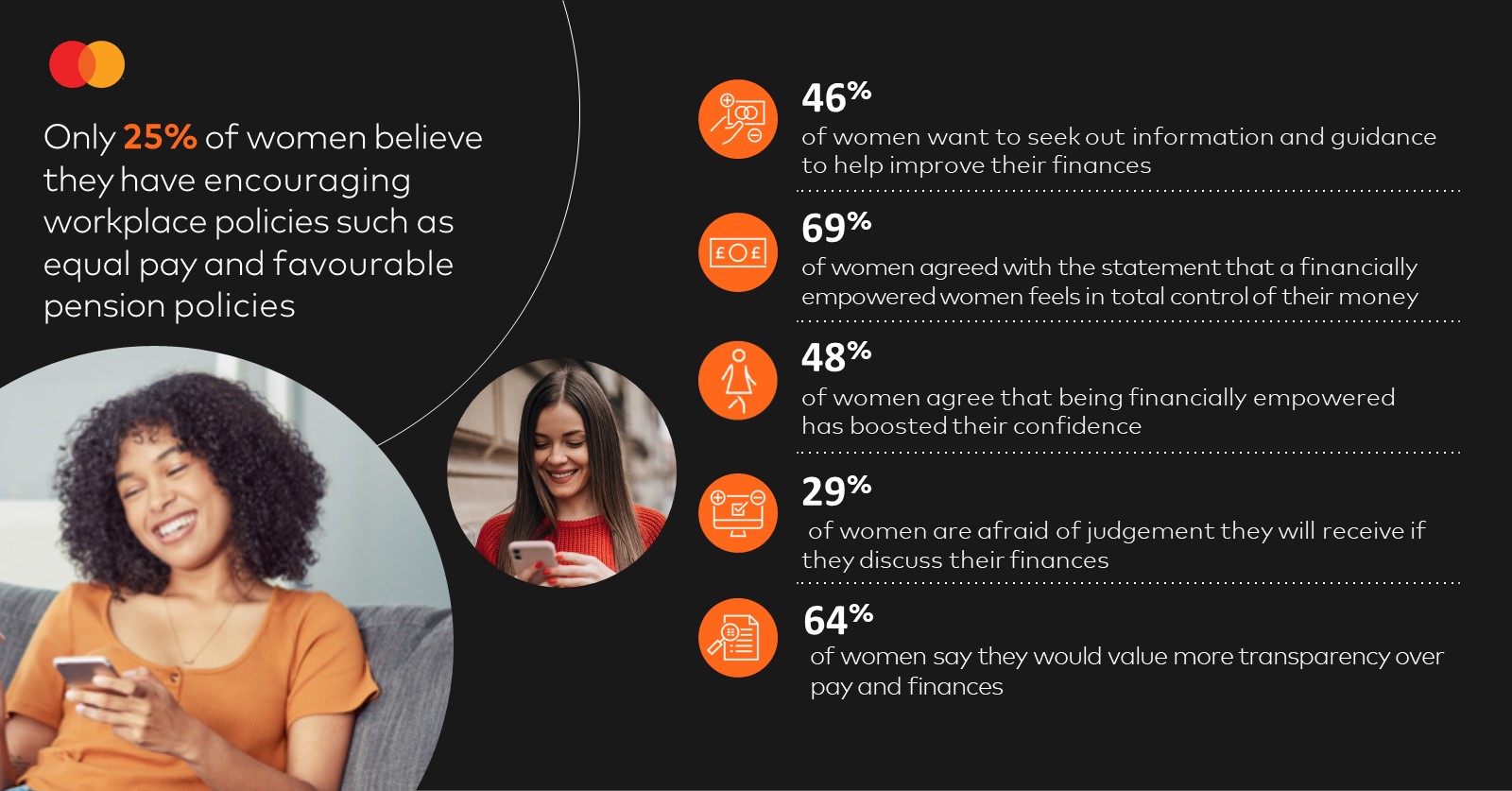

Despite two-thirds describing “financial empowerment” as feeling in total control of their money, disparities in how women feel at home and work are evident.

There is a strong desire for women to seek out information to improve their finances, but nearly a third are afraid of the judgment they will receive if they openly discuss the topic.

Just a quarter of European women feel financially supported in the workplace, Mastercard has today revealed.

Ahead of International Women’s Day, which this year has the theme "Invest in Women, Accelerate progress,” Mastercard conducted a survey1 across 12 European countries to explore whether women feel financially empowered.

A third (34%) of women defined it as a state of no longer having a negative feeling when checking their bank balance, whilst almost a quarter (23%) of women said it means they can help their friends and family financially.

However, the research revealed that women feel financially empowered in only some aspects of their lives.

Obstacles to achieving financial empowerment

Women across the region admitted to a lack of confidence in employers when it comes to financial inclusion, with only 25% of women reporting that they have supportive workplace policies such as equal pay and favourable workplace pension options.

The findings also revealed additional factors holding them back, with women refraining from raising financial issues due to privacy concerns (41%), and almost a third (29%) afraid of the judgement they may receive.

This is despite two-thirds of women (64%) saying they would value more transparency over pay and finances.

With women not expected to earn equal pay for work of equal value until 2277 at the current rate2, the gender pay gap was also highlighted as an obstacle to women’s financial empowerment.

Women in Portugal (41%), Poland (37%), Spain (31%) and Italy (31%) were most likely to feel that the gender wage gap holds back their financial empowerment.

Personal understanding of finances are less of a concern

In contrast to the workplace, women feel more in control of their finances at home. In light of recent economic uncertainty, women say they have high confidence in their understanding of savings (68%) and how to budget (51%). The research also showed they are clear on how mortgages work (42%).

There is large disparity between men and women when it comes to investments however, with 38% of women confident in their understanding on investing compared to 54% of men.

The benefits of being financially empowered were also evident.

For females that do feel financially empowered, almost half agree that it has boosted their confidence, and unsurprisingly, many (46%) therefore have a strong desire to seek out information and guidance to help improve their finances.

Social media is a growing source of advice

In the search for financial advice and to improve their financial confidence, the majority of women are turning to social media for guidance.

Over three quarters (77%) said YouTube videos are an effective form of education, followed by Instagram (64%) and TikTok (62%).

Just 4% turned to digital tools such as AI wealth advisors, even though the vast majority of those that did find them to be effective and useful (77%).

Others prefer turning to online courses and webinars to boost their financial knowledge, with 81% finding them useful.

The research also revealed where women across Europe are most likely to seek their financial advice:

- Poland, (75%), France (69%) and the UK (69%) found TikTok to be an effective source of financial information, while women living in Switzerland (54%) and Austria (50%) were more sceptical of the social media platform.

- However, Swiss women were much more willing to seek advice from colleagues and friends, with the research revealing 46% discuss their finances openly.

- Women living in Spain and Portugal were most likely to turn to friends and family to help with financial decisions (56% and 57% respectively). This was in contrast to women living in Belgium (39%) and France (35%) who felt less supported by those in their inner circles.

“There have been many positive strides towards equality for women in the workplace and beyond in recent years, but there remains progress to be made,” says Eimear Creaven, Western Europe President at Mastercard.

“With the importance of investing in women taking centre stage this International Women’s Day, and only one in four women feeling financially supported in the workplace, there’s a clear opportunity for us to continue our efforts towards uplifting women and their financial empowerment, and ensure inequalities in the workplace are being tackled.

“At Mastercard, we’re focused on designing a better world for women within our workplace and wider society; this includes ensuring equal pay, expanding opportunities for female employees, supporting small business owners and startups, and inspiring STEM careers for young girls to empower the next generation of women.”

Gender equality forms a core part of Mastercard’s organisational DNA. Globally, women at Mastercard earn $1.00 to every $1.00 earned by men based on employees at the same level doing the same work.

Additionally, since 2020, the company has provided 27 million women entrepreneurs with solutions that can help them grow their businesses, surpassing an initial goal of 25 million by 2025.

Through Girls4Tech, Mastercard has also reached almost 6 million girls globally, inspiring them to pursue STEM careers and making a significant step towards empowering the next generation. The program has been carried out in 63 countries, 23 of those being in Europe.

Read more about DEI at Mastercard here.

1 Survey 12,146 consumers (men and women) across the following 12 European markets: UK, Belgium, Germany, Austria, Spain, France, Italy, Poland, Portugal, Netherlands, Switzerland, and Czech Rep. The research fieldwork took place from 2nd – 7th January 2024.

2 It will take 256 more years to close the gender pay gap | World Economic Forum (weforum.org)

About Mastercard (NYSE: MA)

Mastercard powers economies and empowers people in 200+ countries and territories worldwide. Together with our customers, we’re building a sustainable economy where everyone can prosper. We support a wide range of digital payments choices, making transactions secure, simple, smart and accessible. Our technology and innovation, partnerships and networks combine to deliver a unique set of products and services that help people, businesses and governments realize their greatest potential.