Life under the ‘new normal’ accelerates digital banking adoption across Europe

November 19, 2020 | Brussels, BelgiumCOVID-19 has driven Europeans into becoming more digitally savvy when it comes to banking, according to new studies by Mastercard

The rapid digitalisation of lives under lockdown has accelerated the continued interest in digital banking solutions and apps across Europe, with signs of new consumer interests emerging, according to Mastercard’s 2020 European Evolution of Banking study.

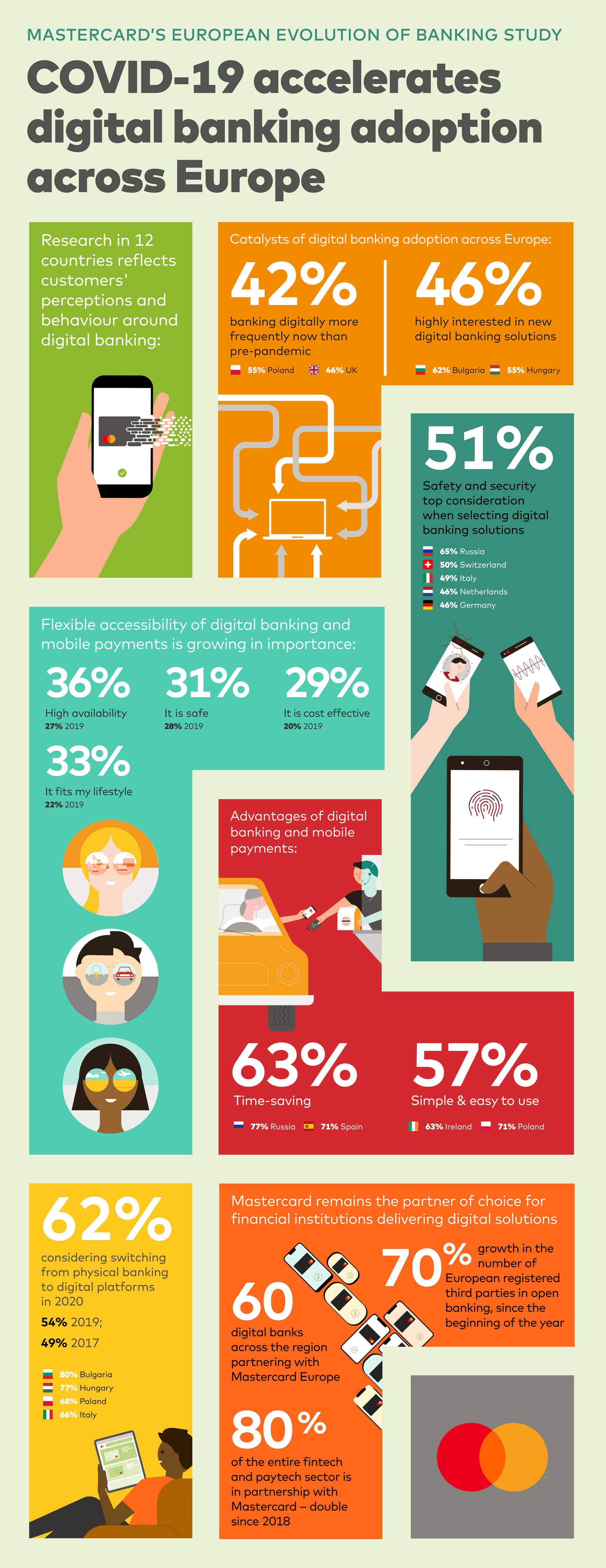

The trend towards digitalisation that we have seen over recent years has gained momentum with COVID-19, as people across the continent had to adapt to physical restrictions. This prompted a sharp surge in online activity and mass adoption of digital banking services as a way to access funds and manage personal finances securely, quickly and conveniently while remote. Examining digital banking trends across 12 European markets, Mastercard’s Evolution of Banking study reveals heightened appetite for online solutions, with 62% of all respondents expressing an interest in switching from physical banking to digital platforms in 2020 – a 13-point rise from only three years prior (source: Mastercard Digital Banking Survey 2017).

These findings correlate with the recent Global State of Pay report – a study commissioned by Mastercard, which found that over half (53%) of the world’s population are using banking apps more than they were before the pandemic. The research – carried out across 14 different countries – also found that people are moving away from cash, with 64% saying they will use physical money less following COVID-19.

Mark Barnett, President of Mastercard Europe, said: “As all of us adjust to our changed and changing reality, there is one truth that has emerged; we are all living digital first lives. As a result, we know people across Europe want simple and secure solutions for all their banking and payment needs. Mastercard is the partner of choice for both established and emerging businesses who seek to digitise and enhance their customers experience. Our focus is on driving innovation that improves people’s everyday banking and payment experiences. Working together with our partners, we are focused on delivering convenient, secure, smart digital interactions that make our everyday activities easier.”

Adoption of digital banking and app solutions soars across Europe

As the pandemic continues to evolve and many countries experience a second wave, the way in which Europeans interact and transact has fundamentally shifted to digital platforms – with video conferencing, online shopping, and remote education booming. Similarly, with lockdown restrictions previously limiting access to physical banks, the majority of Europeans have been exploring new banking solutions which will make their current financial routines easier and safer. Of the over 9,600 Europeans surveyed, 46% said they were highly interested in these new digital banking solutions, while 42% indicated interest subject to assurance of advanced financial security measures.

Interest has also translated into deepened adoption, with more than two in five (42%) Europeans reporting they’re conducting financial transactions online/via an app more frequently now than pre-pandemic mostly thanks to the timesaving and simplicity benefits. Around half (52%) of existing digital banking users indicate that the pandemic hasn’t changed how regularly they’re making financial transactions this year, while only 6% say their online and app-based banking transactions have decreased from 2019. These results are also in line with the global State of Pay study, which reveals that 87% of those who have not used banking apps prior to COVID-19 agree that they will continue to use them after the pandemic.

Eastern Europeans feel particularly positive about fintech futures

Examining openness to digital banking and app solutions across the region, geographically, Eastern European markets are 13 points ahead in expressing positive interest in digital banking platforms, compared to their Western European counterparts (57% vs 44%). Bulgarian (62%) responders expressed the highest levels of interest, followed by Spain (61%) – bucking the overall lower average interest expressed by its Western European neighbours. Those in Germany and the Netherlands are most likely to reject new banking technology and be content with their traditional banking and payment solutions (17%, 18% respectively).

In terms of usage, on average, half of Eastern Europeans (50%) say they conduct more financial transactions online or via an app more frequently now, whereas only 39% of those in Western Europe say the same.

Lockdown lifestyles mean shifts in what is important to digital banking users

This year’s Evolution of Banking study also indicates that European’s priorities are shifting when it comes to the qualities they want to see in online banking and mobile payment solutions compared to 2019. Users are placing more importance on the high availability (+9 points), lifestyle attributes (+11 points) and cost-effectiveness (+9 points) of their digital platforms.

While still seen as the biggest benefits of adopting a digital banking solution, those surveyed said they were slightly less focused on time-saving upsides (down from 66% in 2019 to 63% this year) and ‘easy to use’ qualities (down from 65% in 2019 to 57%) – indicative of shifting lifestyles under lockdown. When not ranking attributes, the majority (51%) stipulated that security was the single most important feature in a digital banking solution, perhaps reflective of rapid upscaling of sophisticated cyber breaches dominating headlines in recent months.

In this digital shift, banks and financial institutions remain trusted by many

Whilst digital banking adoption continues to grow year-on-year, a significant majority (85%) of Europeans still believe that physical banks will exist in their country in 10 years’ time. This is driven in part by many traditional banks increasingly offering digital solutions, resulting in strong customer retention – less than a quarter would switch from their current bank to a digital-only bank in the next 12 months (23%). Added to this 61% of Europeans still see banks as the top provider of financial advice – considerably ahead of friends and family, the media, financial advice companies and others.

Mastercard: The digital banking partner of choice

In 2020, Mastercard remains the partner of choice for financial institutions delivering digital solutions. Mastercard Europe is partnering with more than 60 digital banks across the region and with 80% of the entire fintech and paytech sector, a number which has doubled since just 2018.

A member of Mastercard’s Fintech Express programme, Treezor is an example of a successful partnership to deliver more digitised payments products. “For Treezor, the Mastercard technology, expertise and outreach, as well as its close cooperation made it the obvious choice to partner with. They have always given us an irreproachable support. With Mastercard we can deliver the best and most secure products to our clients” noted Eric Lassus, CEO & Co-founder of Treezor.

Another important partner is Paynetics, which was founded in 2008 with a mission to compress the physical wallet into the mobile phone by digitising loyalty cards, payment cards and cash. “The way we pay and get paid has undergone a huge transformation in 2020, as a result of the COVID-19 pandemic and looming economic crisis – the effects of which will continue to be felt for years to come” said Ivo Gueorguiev, Co-Founder and Executive Chairman Paynetics. “Mastercard helps us bring innovation to the market faster with its unrivalled access and industry insights, marketing support and knowledge of technical infrastructure issues” added Gueorguiev.

Another example of one of our digital banking partners is Orange Bank. According to Narciso Perales, CEO of Orange Bank Spain: “Making easy access to innovative mobile banking services is our reason for being. Partnering with Mastercard has enabled us to provide our clients a 100% mobile card. Being the first company in Europe to enter the Mastercard Digital First program has propelled us to spearhead innovation in our industry”.

Please click on the following links Bnext, Bunq, Curve, Monese, Orange Bank, Paynetics, Rebellion, Stocard, Treezor and Vanta to read the case studies of some of our digital banking partners.

For more information and imagery please contact Rose Beaumont or Aylin Fastenau on Rose.Beaumont@mastercard.com / Aylin.Fastenau@mastercard.com

About Mastercard’s European Evolution of Banking Study

The research was carried out by Ketchum Research and Analytics, on behalf of Mastercard. A total of 9,605 people aged 18+ were surveyed across 12 key markets. Fieldwork ran from 18th – 27th September 2020 and was conducted by Vitreous World.

About Mastercard (NYSE: MA)

Mastercard powers economies and empowers people in 200+ countries and territories worldwide. Together with our customers, we’re building a sustainable economy where everyone can prosper. We support a wide range of digital payments choices, making transactions secure, simple, smart and accessible. Our technology and innovation, partnerships and networks combine to deliver a unique set of products and services that help people, businesses and governments realize their greatest potential.