Mastercard study shows consumers moving to contactless payments for everyday purchases as they seek cleaner, touch-free options

April 30, 2020 | SINGAPORE | By Barkha Patel- In Mastercard global consumer survey, nearly eight in 10 say they use contactless payments

- Between February and March, tap-and-go transactions in Asia Pacific grew 2.5 times faster than non-contactless transactions in the grocery and drug store categories

- Asia Pacific leads worldwide in contactless usage; majority of consumers believe it is the cleaner, safer way to pay

During February and March, as many countries imposed or strengthened social distancing measures due to COVID-19, a significant majority of consumers turned to contactless card payments for necessary purchases. Citing safety and cleanliness, 79 percent of people worldwide and 91 percent in Asia Pacific say they are now using tap-and-go payments.

Consumer polling by Mastercard, studying changing consumer behaviors in 19 countries around the world, paints a picture of accelerated and sustained contactless adoption.

The act of going to the store for eggs, toilet paper, medicine and other necessities has changed dramatically this year. Shoppers have had to adjust to new challenges when buying everyday supplies – a shift in behavior that is particularly clear at checkout as people express a desire for contactless cards and voice concerns over cleanliness and safety at the point of sale.

The new Mastercard survey shows:

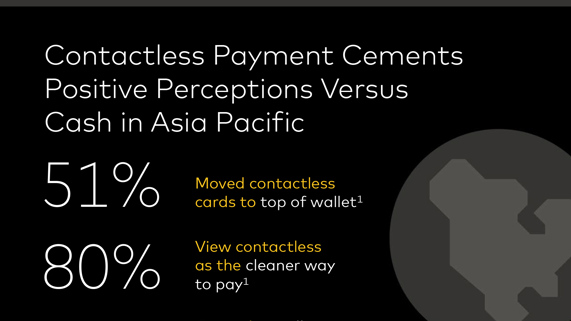

- Contactless cards move to top of wallet – Perceptions of safety and convenience have spurred a preference for contactless cards and reminded consumers of the ease of tapping. Globally, 46 percent of respondents have swapped their top-of-wallet card for one that offers contactless. In Asia Pacific, 51 percent of people have made the swap.

- Confidence in contactless – COVID-19 has increased concerns about cash usage and led to positive perceptions about contactless due to the safety and peace of mind it provides. The majority of respondents (82 percent) globally view contactless as the cleaner way to pay, with 80 percent in Asia Pacific saying the same. Contactless payments are up to 10 times faster than other in-person payment methods, enabling customers to get in and out of stores faster.

- Contactless is here to stay – We are in a sustained period where consumers are making purchases in a very focused way. That’s reinforcing contactless use in markets where adoption is more mature and it’s stimulating use in newer markets. This trend appears to be here to stay as 74 percent of people globally and 75 percent in Asia Pacific state they will continue to use contactless after the pandemic is over.

“Mastercard’s survey shows a clear shift to contactless – especially in Asia Pacific – as COVID-19 changes the payments landscape and the way people shop now and in the future,” said Sandeep Malhotra, Executive Vice President, Products & Innovation, Asia Pacific, Mastercard. “The fact that 3 in 4 people intend to keep using tap-and-go after the pandemic is a strong sign that consumers see the long-term benefits of having a safer, cleaner way to pay, checking out faster and being more socially responsible.”

Contactless Tipping Point

Mastercard has been spearheading the worldwide shift to contactless for years, championing the simple, safe and fast way to pay. Now, as consumers increasingly seek ways to get in and out of stores quickly without touching payment terminals, Mastercard data reveals more than 40 percent growth in contactless transactions globally in the first quarter of 20201. More than 80 percent of contactless transactions are under US$25, a range typically dominated by cash.

While countries worldwide are at different stages of contactless card deployment and usage for daily shopping, Mastercard’s insights on trends at grocery stores and pharmacies – where many day-to-day essentials are being purchased – showed nearly all regions experienced significant spikes in February and March.

Reinforcing changing behaviors and consumer checkout preferences, Mastercard saw the number of tap-and-go card payments at grocery stores and pharmacies grow twice as fast as non-contactless transactions globally and 2.5 times faster in Asia Pacific2.

Just last month, Mastercard announced commitments to increase contactless payment limits in more than 50 countries worldwide in Europe, the Middle East, Africa, Asia Pacific, Canada, Latin America and the Caribbean. Limit increases were part of Mastercard’s global effort to make sure consumers, merchants and small businesses have the resources to pay safely, receive payment and maintain operations during the COVID-19 crisis.

###

Notes to Editors

1 Growth calculated as the percentage increase in contactless transactions compared to the percentage increase in non-contactless transactions, comparing March 2020 to March 2019, in the grocery and pharmacy categories. Source: Mastercard Data Warehouse

2 Growth calculated as the percentage increase in contactless transactions compared to the percentage increase in non-contactless transactions, comparing March 2020 to February 2020, at Grocery and Pharmacy categories. Source: Mastercard Data Warehouse

Survey Methodology

- Online interviews of 17,000 consumers in 19 countries worldwide

- 1,000 banked respondents per country in the United States and Canada (North America); Australia, Singapore (Asia Pacific); UAE, Kingdom of Saudi Arabia, South Africa (Middle East and Africa); United Kingdom, Italy, France, Germany, Spain, Poland, Russia, the Netherlands (Europe)

- 500 banked respondents per country in Brazil, Costa Rica, Dominican Republic, and Colombia (Latin America and the Caribbean)

- Research conducted April 10-12, 2020

- Nationally representative sample

- Readable sample sizes of:

- Gen Z and Millennials

- Affluent [defined at a country level]

- Contactless users

- Primary shoppers

- Those with high levels of concern about COVID-19

About Mastercard

Mastercard powers economies and empowers people in 200+ countries and territories worldwide. Together with our customers, we’re building a resilient economy where everyone can prosper. We support a wide range of digital payments choices, making transactions secure, simple, smart and accessible. Our technology and innovation, partnerships and networks combine to deliver a unique set of products and services that help people, businesses and governments realize their greatest potential.