Mastercard and HSBC Unveil First Mobile Virtual Corporate Card in Hong Kong

June 19, 2025 | Hong KongEnabling efficient expense management and mobile contactless payment for businesses

Mastercard and HSBC today jointly announced the launch of Hong Kong’s first mobile virtual corporate card for commercial customers. Combining Mastercard’s technology and HSBC’s client network, this new solution will empower businesses in Hong Kong with seamless, secure and efficient on-demand payment management.

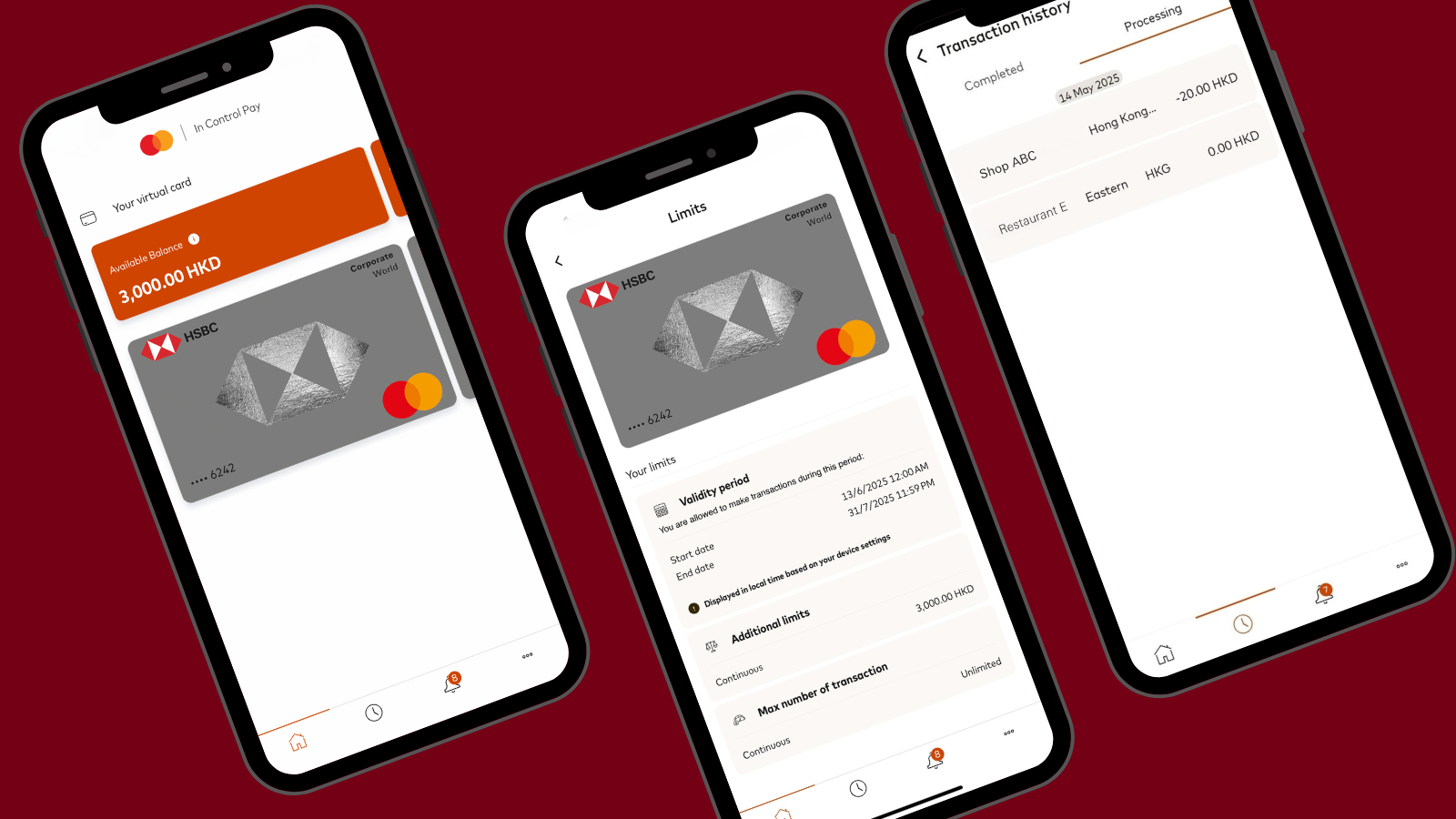

Starting today, eligible HSBC commercial customers enrolled in the HSBC Virtual Mastercard Programme will be able to utilize the new digital wallet compatibility for virtual cards. The enhancement allows business to use virtual cards at physical point-of-sale terminals, as well as for online and in-app purchases. Businesses can instantly issue virtual cards through the virtual card portal, while users can add them to compatible digital wallets for immediate use via the Mastercard In Control Pay mobile app. With centralized control, businesses can activate or deactivate the mobile virtual cards anytime, anywhere. Additionally, businesses can set specific timeframes for virtual cards, providing flexibility to suit diverse operational needs.

Yvonne Yiu, Head of Global Payments Solutions, Greater China, HSBC, said, “Hong Kong has emerged as one of the world’s top markets for mobile wallet adoption, with over 80 percent of its population using them for payments.1 We are pleased to team up with Mastercard to introduce mobile virtual corporate cards for businesses. This solution elevates the benefits of virtual cards by integrating them with the simplicity and convenience of mobile payments, enabling effortless transactions for both online and in-store purchases as well as supplier payments. As a world-leading transaction bank, we remain committed to enhancing our corporate payment solutions to meet the evolving needs of businesses.”

Helena Chen, Senior Vice President, General Manager, Hong Kong and Macau, Mastercard, said, “Mastercard is pleased to partner with HSBC as the first issuer in Hong Kong to launch this new mobile virtual corporate card. Organizations are increasingly looking to leverage virtual card solutions to enhance their payment processes, with an expected 44 percent increase in virtual card adoption from 2022 to 20252. Leveraging our technological know-how and expertise in virtual card solutions, Mastercard is committed to working together with HSBC to roll out products that address companies’ B2B payment challenges. Mastercard looks forward to unlocking a new segment of cardholders while helping businesses to improve cash flow and streamline their accounts payable processes, allowing them to focus more on their core business operations.”

In the first quarter of 2025, Mastercard contactless transactions made up more than 83 percent of global card-present purchases (excluding the US)3. This reflects a year-on-year increase of nearly 3.1 billion transactions3, underscoring the strong and growing demand for contactless payment.

The new mobile virtual corporate card solution offers a range of benefits for businesses with the Mastercard In Control Pay mobile app:

· Instant card access: No wait and no risk of card misdelivery. Once businesses issue the virtual cards, users can access their cards within the app upon a simple sign-up process.

· Streamlined checkout process: By seamlessly adding virtual cards to digital wallets, users can experience quicker checkouts and instant payment coupled with Mastercard’s acceptance network, while eliminating plastic and waiting time for receiving physical cards in the mail.

· Budget tracking and control: Companies can easily track budget spending, with spend controls that regulate how, when and where virtual card can be used. At the same time, they can enjoy better spend visibility through automated reconciliation. For virtual card users, they can also check the card limit, available balance, and near-real-time transaction records on the app.

· Fraud protection: Tokenized transactions keep real card numbers shielded from merchants, reducing misuse and unauthorized transactions.

· Efficient invoice management: Companies can enjoy efficient digital processes for invoice payments and approvals, as well as avoiding one-time supplier set-ups.

1 Global Data (https://www.globaldata.com/media/banking/90-hong-kong-residents-use-mobile-wallets-for-payments-reveals-globaldata/)

2 2022 Virtual Card Benchmark Survey Results, RPMG Research Corporation, May 2022

3 Anonymized and aggregated data from the Mastercard Data Warehouse, Q1 2025

About The Hongkong and Shanghai Banking Corporation Limited

The Hongkong and Shanghai Banking Corporation Limited is the founding member of the HSBC Group. HSBC serves customers worldwide from offices in 58 countries and territories. With assets of US$3,054bn at 31 March 2025, HSBC is one of the world’s largest banking and financial services organisations.

About Mastercard

Mastercard powers economies and empowers people in 200+ countries and territories worldwide. Together with our customers, we’re building a resilient economy where everyone can prosper. We support a wide range of digital payments choices, making transactions secure, simple, smart and accessible. Our technology and innovation, partnerships and networks combine to deliver a unique set of products and services that help people, businesses and governments realize their greatest potential.