HSBC Launches Mastercard Supplementary Debit Card in Hong Kong

February 25, 2022 | Hong KongMarket’s first multi-currency supplementary card for 12-year-olds and above with no bank account required

HSBC Jade Mastercard Supplementary Debit Card and HSBC Mastercard Supplementary Debit Card are officially launched today in Hong Kong for applicants aged 12 or above, with no bank account required. First of its kind, these cards enable transactions in 12 major currencies1, as well as fee-free cash withdrawal2 from HSBC’s global ATM network, making them a must-have for international travellers and overseas students.

Without any foreign currency transaction fee or annual fee, transactions and withdrawals with these cards will be settled by debiting directly from the principal cardholder’s saving account of the corresponding foreign currency3.

A combined total of over 300,000 HSBC Jade Mastercard Debit Cards and HSBC Mastercard Debit Cards have been issued since their launch in 2019 and 2020 respectively. Meanwhile, overseas expenditure accounted for over half of these cardholders’ total spending in the past 6 months.

Amy Kam, Head of Cards and Personal Lending, Wealth and Personal Banking, Hong Kong, HSBC, said: “Studying abroad has become increasingly popular in Hong Kong. This is a quintessential example of our support not only to customers, but their dependent family members who also have their own ambitions at different ages. Through HSBC HK Mobile App, it is simple and easy to obtain a supplementary card for family members, who can pay for their overseas expenses and get cash outside of Hong Kong even without an offshore bank account. With full visibility of all card transactions, parents can also enjoy a peace of mind and support their children to achieve financial discipline.”

Helena Chen, Managing Director, Hong Kong and Macau, Mastercard, said: “Highlighting its commitment to providing safe, secure and seamless payment methods for cardholders, the new Mastercard Supplementary Debit Card in cooperation with HSBC offers Hong Kong families easy, digitally ready payment, greater flexibility and security while also allowing the young ones to learn more about financial responsibility and management. Furthermore, it is now much easier for children to take control of their spending when shopping online, traveling or studying abroad with the card being built around 12 major currencies, so they can conveniently purchase or get cash from any ATM that accepts Mastercard cards around the world, and with zero fees when withdrawing from HSBC ATMs."

Through HSBC HK Mobile Banking app, principal cardholders can manage activities of the supplementary cards, such as setting spending and withdrawal limits or activating a temporary card suspension. Separately, principal cardholders can keep sight of their dependent’s personal finances, as there will be real time alerts on all supplementary card’s activities.

Each HSBC Mastercard Debit Card cardholder can apply for a maximum of six supplementary debit cards, and enjoy up to 0.5 per cent cash rebate4 on all eligible transactions made by the supplementary cards.

1 The 12 designated currencies include AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, RMB, SGD, THB and

2 In addition, HSBC Jade Mastercard Debit Card cardholders can enjoy fee-free cash withdrawal at ATMs that carry the Mastercard/Cirrus logo anywhere in the world; overseas ATM daily withdrawal limit is pre-set to zero to strengthen security controls for ATM Prior setting of overseas ATM withdrawal limit is required to enable overseas cash withdrawal.

3 The Mastercard FX rate will be applied for transactions outside of the 12 designated currencies and to be settled in HKD. No foreign currency transaction mark-up will be

4 For eligible transactions by the supplementary cards, HSBC Jade Mastercard Debit Card principal cardholders can enjoy 0.5 per cent cash rebate while cash rebate for HSBC Mastercard Debit Card principal cardholders is at 0.4 per cent. Terms and conditions apply.

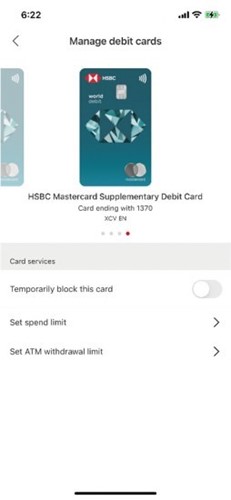

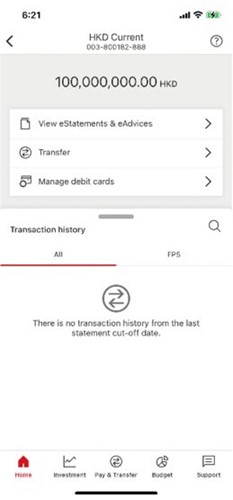

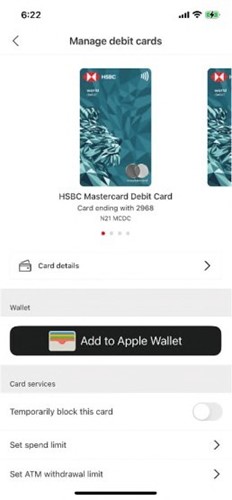

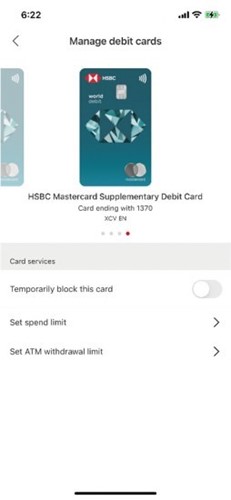

4 steps to manage activities on supplementary debit card

Step 1

Log on to HSBC HK Mobile Banking app and select any account linked to the debit card.

Step 2

Tap “Manage debit cards”.

Step 3

The Mastercard principal card will be shown.

Step 4

Swipe to the right from the card face to select the supplementary card and change the setting below.

About The Hongkong and Shanghai Banking Corporation Limited

The Hongkong and Shanghai Banking Corporation Limited is the founding member of the HSBC Group. HSBC serves customers worldwide from offices in 64 countries and territories in its geographical regions: Europe, Asia, North America, Latin America, and Middle East and North Africa. With assets of $2,969bn at 30 September 2021, HSBC is one of the world’s largest banking and financial services organisations.

About Mastercard (NYSE: MA) www.mastercard.com

Mastercard is a global technology company in the payments industry. Our mission is to connect and power an inclusive, digital economy that benefits everyone, everywhere by making transactions safe, simple, smart and accessible. Using secure data and networks, partnerships and passion, our innovations and solutions help individuals, financial institutions, governments and businesses realize their greatest potential. Our decency quotient, or DQ, drives our culture and everything we do inside and outside of our company. With connections across more than 210 countries and territories, we are building a sustainable world that unlocks priceless possibilities for all.

About Mastercard

Mastercard powers economies and empowers people in 200+ countries and territories worldwide. Together with our customers, we’re building a resilient economy where everyone can prosper. We support a wide range of digital payments choices, making transactions secure, simple, smart and accessible. Our technology and innovation, partnerships and networks combine to deliver a unique set of products and services that help people, businesses and governments realize their greatest potential.