Four Facts about the Numberless Physical Card from Mastercard

June 10, 2020 | HONG KONGVirtual banks have been making progress towards launching in Hong Kong in recent months, with many of them striving to deliver an unprecedented fintech experience to their customers through revolutionary products and services, such as the numberless physical card.

Before this innovation, valid physical payment cards always had to carry information including the card number, expiry date and a card verification code (CVC2) to identify the cardholder’s identity and the authenticity of the payment card. The new numberless physical card contains only a chip, the cardholder’s name, and the logos of the issuing bank and credit card brand, making it seem like a personal name card.

Consumers and merchants used to traditional physical payment cards might look at these numberless physical cards and ask, “Is this a fake card?” In view of this, Mastercard provides these answers to frequently asked questions, so that you can have a more thorough understanding on these new numberless physical cards and catch up with the latest fintech development trend.

Four facts about numberless physical card

- Why is the numberless physical card safer than the traditional physical card?

Through the world’s fastest and most reliable global payments network, Mastercard numberless physical card cardholders enjoy the same robust and multi-layered security protections that come with paying via the existing Mastercard payment solution. The numberless physical card only shows the cardholder’s name while information such as the card number and its expiry date, which are usually printed on traditional cards, would instead be saved in the physical card’s chip. These pieces of information, as well as the card verification value (CVC2) normally printed at the back of traditional cards, would be shown on the digital card via the bank’s mobile app – further enhancing privacy and security levels. Cardholders can simply login to the bank’s mobile app and verify their identities to obtain the required information for online shopping.

- How can one apply for a numberless physical card?

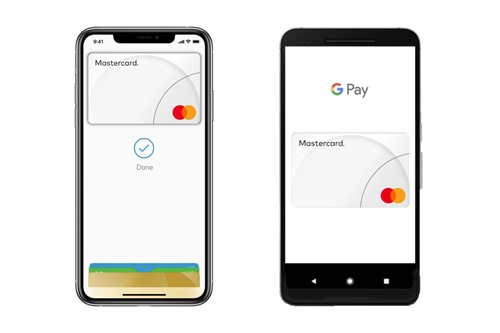

The numberless physical card adopts the “digital-first” principle. Digital cards could be applied for through the online channels provided by the issuing bank, to be activated following the bank’s instructions and bound to cardholders’ electronic wallets. The payment procedure is the same as using existing mobile payment methods. Numberless physical card also made available by the bank to take care of their day- to-day consumption depending on their personal needs.

- How to use a numberless physical card?

Cardholders enjoy ATM services at JETCO ATMs in Hong Kong, and all ATMs globally that accept Mastercard cards after successful activation. When using a numberless physical card, cardholders and merchants can also choose to settle transactions via contactless, chip or magnetic strip payment, just like how traditional physical Mastercard cards are processed. - Are there any restrictions on transactions using the numberless physical card?

Apart from the transaction limit set by the bank, some banks may offer the functionality for cardholders to set their monthly spending limits for each consumption category via their mobile banking app, according to their personal financial habits. When their consumption amounts reach their respective ceilings, the system will automatically limit the transaction. Cardholders can also use the bank's mobile app to check transaction records in real time, thus greatly improving the efficiency of financial management.

“Mastercard is committed to providing a safe, fast and convenient electronic and cashless payments experience to consumers and merchants. Through partnering with virtual banks to launch the “digital- first” numberless physical card, Mastercard enhances the safety and security level of the new generation payment card, further pushing forward the development of Hong Kong as a smart city,” said Helena Chen, managing director, Hong Kong and Macau, Mastercard.

Not only can the numberless physical card enhance security, it also gives the issuing bank greater flexibility in designing their cards. Compared to traditional physical payment cards, the design and materials of the currently available numberless physical cards in the local market are more creative and innovative, such as using a unique reflective effect or lake blue on the card face, or being made of black stainless steel. Want to be trendy and fashionable while making the safest and most secure payments? Follow the news and latest trends about virtual banks and apply for the new numberless physical card now!

About Mastercard (NYSE: MA), www.mastercard.com

Mastercard is a global technology company in the payments industry. Our mission is to connect and power an inclusive, digital economy that benefits everyone, everywhere by making transactions safe, simple, smart and accessible. Using secure data and networks, partnerships and passion, our innovations and solutions help individuals, financial institutions, governments and businesses realize their greatest potential. Our decency quotient, or DQ, drives our culture and everything we do inside and outside of our company. With connections across more than 210 countries and territories, we are building a sustainable world that unlocks priceless possibilities for all.

Mastercard Communications Contact

Karen Lo

Karen.Lo@mastercard.com

Janus Lau

Janus.Lau@matercard.com

Agency Communications Contact

Vicky Lo

(852) 2533 9940

vlo@webershandwick.com

Sam Cho

(852) 2533 9982

scho@webershandwick.com