Data is the fuel of personalisation, allowing brands to understand customer preferences and deliver relevant content and offers. FIs, like many businesses that have unique datasets, often lack efficient integration and curation processes to share data across tech stacks and siloed teams and effectively deliver tailored experiences. In fact, 80% of banks report that they collect so much data that they cannot seamlessly integrate it into their engagement systems.

Successful personalisation efforts need dedicated owners to manage these robust processes and co-ordinate efforts across teams, but 63% of banks globally say they operate without a primary business resource wholly devoted to personalisation. In a world with rising customer acquisition costs, most banks just can’t justify dedicating headcount to projects with anything more than a quick time-to-value.

Lack of internal resources:

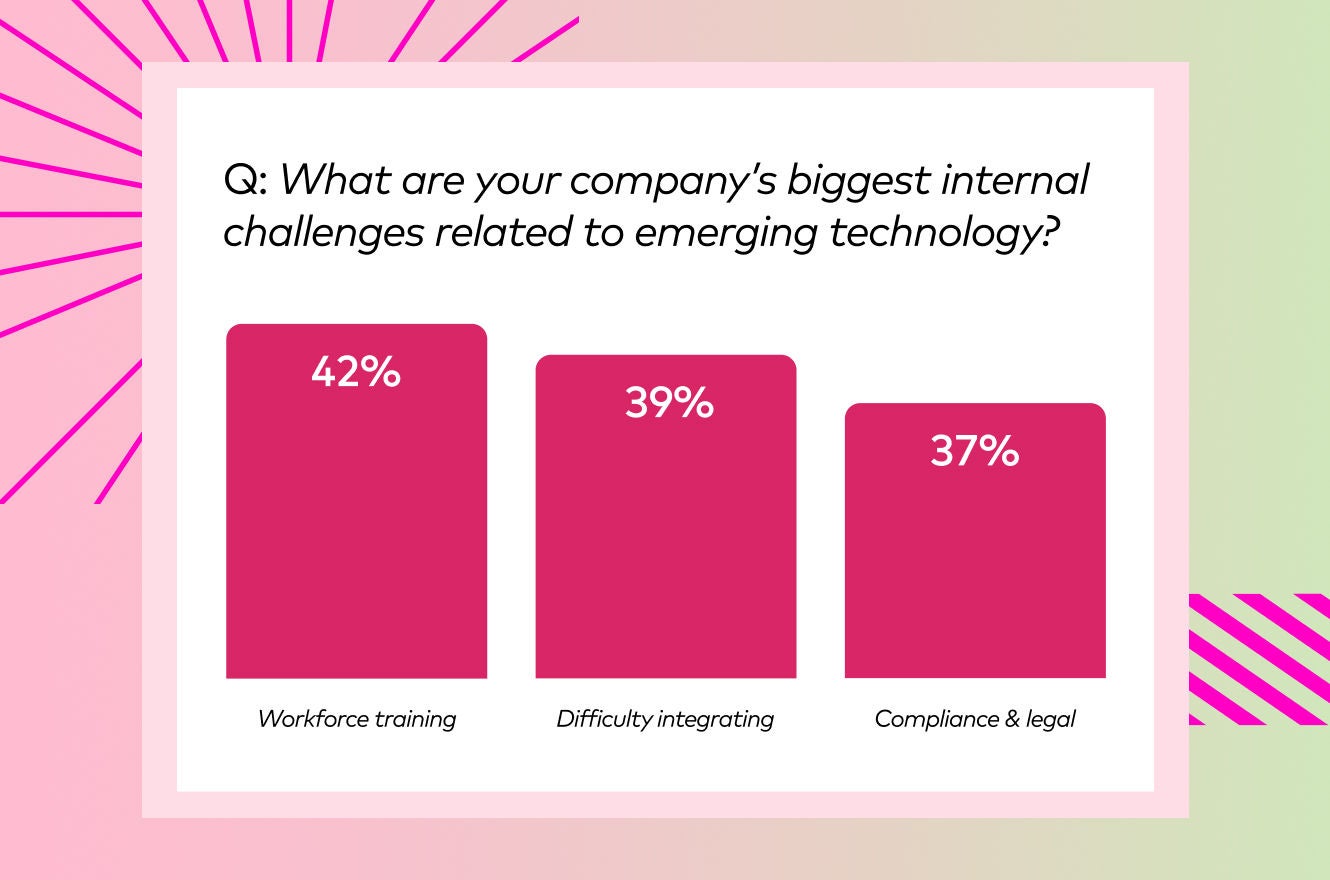

Just as securing headcount is a pervasive issue, so too is the challenge of hiring. In fact, 42% of financial institutions report that internal resources and workforce training are their greatest challenges in implementing effective personalisation. The expertise needed to drive successful personalisation programmes is not yet developed en masse for FIs, making it even more difficult and costly for banks to hire these positions. The candidates who fully understand the requirements are hired at a premium, while less-experienced programme hires need increased onboarding time and more opportunities for trial and error.

Additionally, the portfolio-centric organisation of banks means that personnel are more likely focused on making sure the whole programme thrives rather than whether customers click a personalised email. With other opportunities competing for time and attention, most banks haven’t invested in growing personalisation’s progressive edge.

Compliance challenges:

Even so, banks that do invest resources in dedicated programmes are swiftly met with the extra time and attention needed to comply with stringent legal and regulatory requirements. 37% of FIs say these requirements are their greatest personalisation challenge. Personalisation teams must work to constantly verify how their strategies adhere to current highly matrixed data protection and privacy laws while also anticipating future requirements.

If a bank has placed personalisation as a clear, visible priority of the company and the overall digital strategy, it can be easier to navigate compliance challenges due to a more mature awareness of the discipline’s nuances. However, only 29% of banks report that personalisation is part of their DNA. Largely, legacy systems and hierarchical structures within banks prevent the agile and collaborative approaches needed for cultural change.

Integration complexity:

Those stringent legal and regulatory requirements also prevent banks from onboarding proper personalisation software in the first place. Often banks are locked into legacy technology. Even if a bank can “turn on” personalisation as part of a larger suite, it’s unlikely that these existing technologies offer purpose-built machine learning models that analyse and predict intent throughout the banking customer lifecycle. For the lucky few banks that can onboard a new technology, it’s an uphill battle connecting it to the rest of their tech stack due to compliance concerns, creating data-integration issues and preventing banks from scaling omnichannel experiences.