Mastercard and tokenisation

Mastercard's role in advancing payment tokenisation underscores the technology's importance. Since 2022, Mastercard has doubled its volume of tokenised transactions, processing over 4 billion such transactions in a single month and enabling safer payments across more than 110 countries.

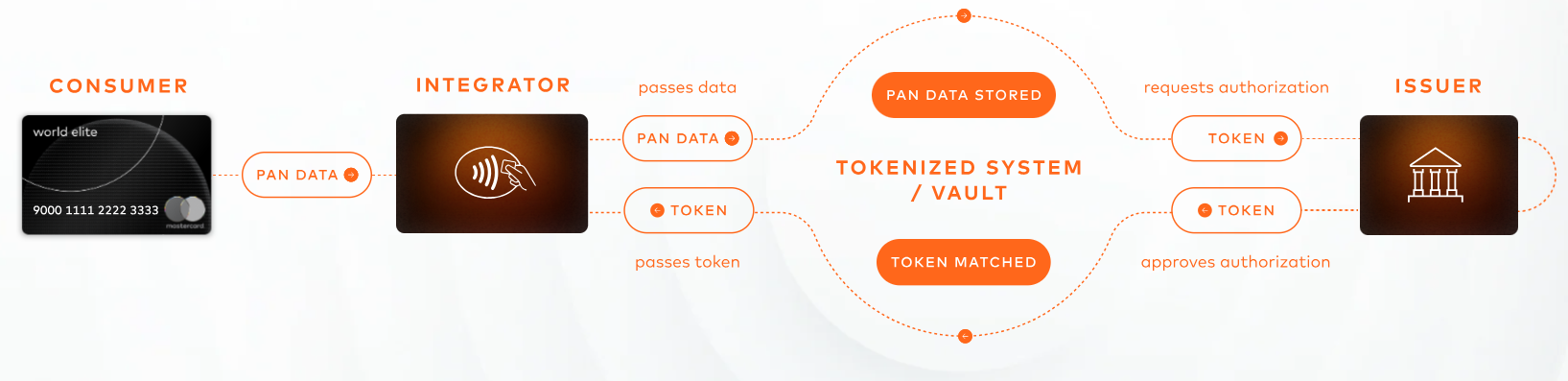

Mastercard Digital Enablement Service

Launched in 2014, the Mastercard Digital Enablement Service (MDES) is a single integrated platform for issuers, wallet providers, merchants and other token requestors to enable the digitisation of supported Mastercard card types for many digital payment methods. MDES end-to-end services are supported by the reliability and global reach of the Mastercard network. Besides tokenisation services for issuers and merchants, MDES provides to financial institutions a range of services that reduce data risk with simple, secure and scalable solutions. In addition, MDES provides secure digital payments for any wallet type.

Multi-Token Network

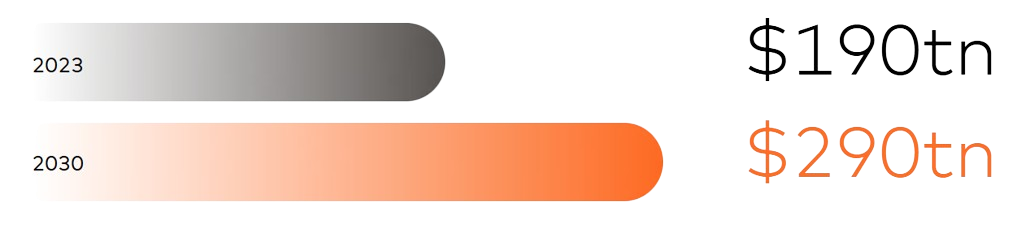

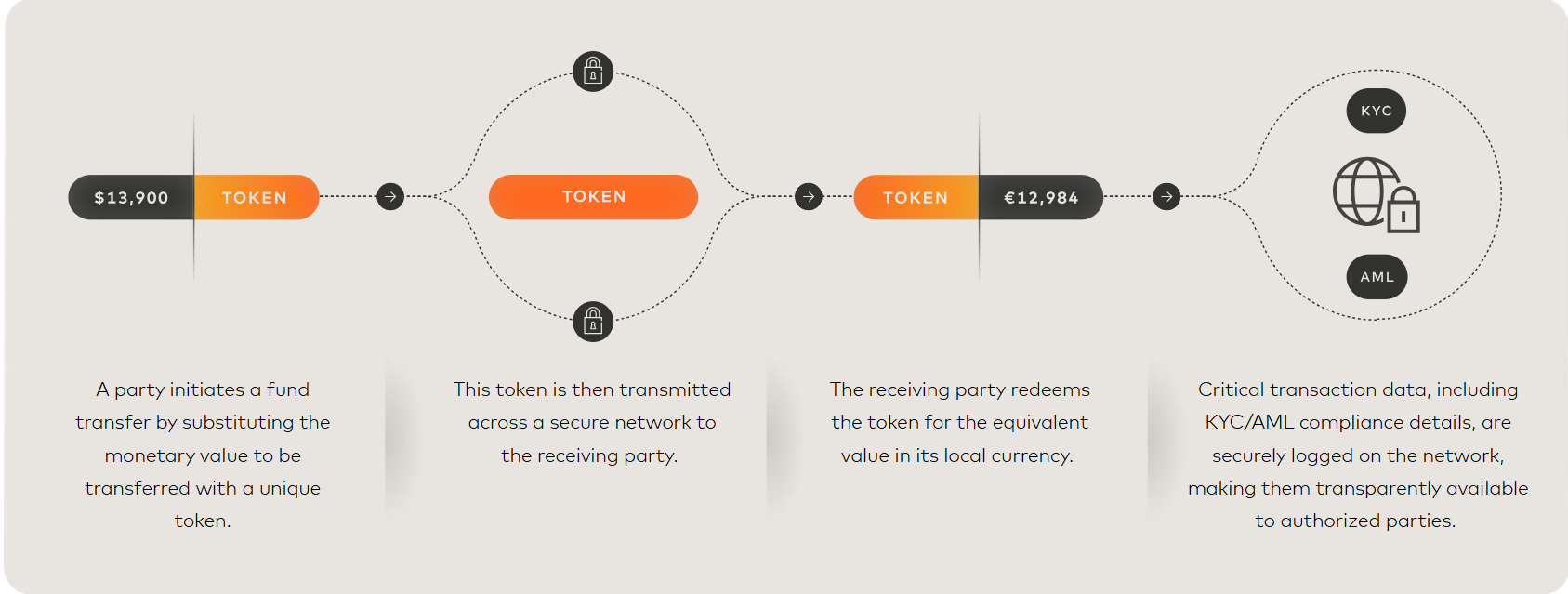

Mastercard is developing the Multi-Token Network (MTN) to facilitate broader mainstream adoption of blockchain and digital asset technologies for businesses and consumers in a manner that is intended to preserve the integrity of today’s regulated financial system.

MTN creates a more reliable and predictable way for consumers and businesses to interact with digital asset ecosystems. It establishes a secure space for highly-regulated financial institutions, such as banks, to explore and deploy new applications and services. MTN also paves the way for the adoption of a wide range of digital asset use cases, expanding choice for consumers, driving competition in digital markets and setting in motion a virtuous circle of innovation for the larger development community.

In select countries, the MTN beta is now acting as a testbed for new payments and commerce capabilities. Mastercard strives to ensure that from day one, our network is valuable to all participants, empowering people and businesses everywhere to transact with digital assets with greater flexibility, efficiency and control.

Mastercard Payment Passkey Service

Mastercard Payment Passkey Service uses tokenisation and device-based biometric authentication methods, such as fingerprints or facial scans, to secure a consumer’s online checkout interaction, ensuring the transaction is secure and no financial account data is shared with third parties — rendering it useless to fraudsters and scammers. By replacing traditional passwords and OTPs, the Mastercard Payment Passkey Service makes transactions not only more secure, but also faster, representing a game changer for online commerce.